Yearning for some semblance of normalcy, a sizeable portion of the public is rushing back to bars and restaurants determined to make up for the fun halted by the pandemic. But there is no going back to “business as usual”… at least not yet. Labor and product shortages, rising prices and the highly infectious Delta variant remain challenges.

Consumers may be “roaring” back into restaurants and bars, but can the on-premise meet their changed expectations with so many hurdles to overcome?

After a year-and-a-half of rough sailing through a turbulent pandemic, the on-premise is bouncing back. Pent up demand to leave the house and socialize has been building for months as consumers become more confident that it is safe to spend time in bars and restaurants. This is leading to a phenomenon some are calling the “Roaring 2020s.” And though we’re not likely to see a resurgence of flapper dresses any time soon, there is no doubt that customers are excited to let loose.

Success and Struggle

At press time and before the COVID Delta variant became an issue, data showed that nearly 75% of consumers across the country had returned to the on-premise, at least in part. In May, Yelp reported that more than 3.7 million diners used the app to book tables, it’s highest total ever. In fact, the number of diners seated surpassed pre-pandemic levels in nearly every US state and in all but a few major metropolitan markets, signaling the beginning of nationwide recovery.

“I think what we’re seeing is the core business coming back, and it’s probably back to ‘normal,’ if not above,” NBWA chief economist Lester Jones told Beer Business Daily. But Jones notes that the industry is still waiting for business like large gatherings, travel, and amusement parks.

The desire to socialize in public spaces is palpable. But some bars and restaurants are having a difficult time keeping up.

Mary Pat Parson, Marketing and Events Coordinator for Mudhen Brewing Company and Dogtooth Bar and Grill says, “In Wildwood, we have had our busiest season in over 60 years. It doesn’t matter whether it is a Tuesday or a Saturday, we have a line out the door. We have experienced staffing issues this season and it has not been easy. To make up for the lack of help, our people have stepped up in a tremendous way, whether it be working doubles, not taking days off, etc. We are truly grateful for the blood, sweat, and tears of our staff, from the kitchen to the brewery, and everywhere in between.” She continues to say, “We have had shortages in everything from chicken wings to cans to merchandise.”

John Exadaktilos, also known as “Johnny X,” from Ducktown Tavern in Atlantic City, explains that, while they have not faced the same staffing shortages other bars and restaurants have, he has struggled in other aspects. Similarly to Mudhen, he explains how he was forced to take chicken wings and crab cakes off the menu. “The cost was simply too high to pass on to our customers. We replaced the wings with boneless nuggets , he continues, “It’s really no one’s fault. Its out of everyone’s control.”

Our brewery partners have also been subjected to many shortages. Brian Needham, Head of Sales at Double Nickel Brewing Company says, “Cans have been a nightmare. We placed an order and it took an entire year to show up.” They have also been challenged with everything from glassware to fruit from sours. “We just keep zigging and zagging and try to do our best not to pass along the cost to the consumer.”

Driving the Return

According to a survey conducted by Nielsen, consumers over 55 are driving the return of the on-premise when it comes to food purchases, while those under 55 lead for drink-driven purchases. Catching up with friends was the main occasion for visiting bars and restaurants this summer, with ‘winding down/chilling out’ also a popular occasion with consumers under 55.

Almost 80% of customers are spending as much or more than they did on-premise, pre-COVID, with soft drinks and beer leading the way for drink purchases. A poll by Nielsen showed that in surveyed markets, the breakdown of purchases from those who have visited a restaurant or bar since reopening is as follows: 37% have purchased soft drinks, 34% have ordered beer and 23% have ordered a cocktail. Hard seltzer clocks in at 10% – behind shots and energy drinks (both 12%). While it may seem surprising that hard seltzer is coming in behind other

categories, remember that the style is still relatively new to the on-premise, and will likely build over time.

“Hard seltzers were in higher demand this summer than any other,” says Greg Batz, Kramer Beverage’s National Accounts and Casino Manager, “as demand continues to grow, beach, deck, and pools added more seltzer options, as did many other bars. Casinos also ran a test on the gaming floors in the spring and it turned out to be a huge success.”

Keep the Momentum Going in Spite of the Pandemic

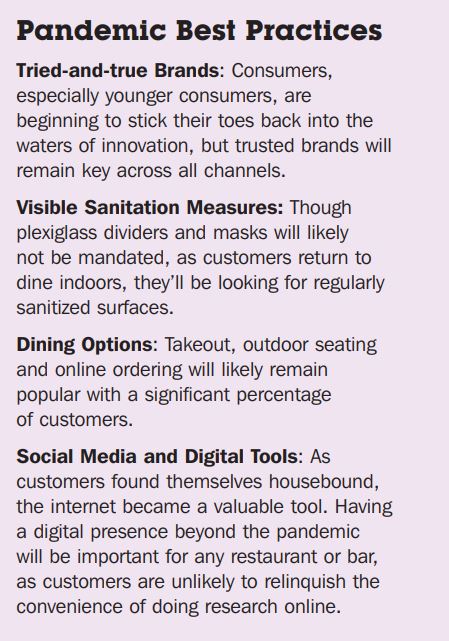

How to keep on-premise growth going is on everyone’s minds as we move into fall, a new flu season and a very “fluid” pandemic. But even in these uncertain times, keeping customers happy (and comfortable entering your bar or restaurant) comes down to a few key components, according to research conducted by Molson Coors.

Familiarity – While consumers will eventually seek out innovation again, 70% say that they’ll stick to familiar food and beverage brands as they return to the on-premise post-pandemic and 47% of on-premise beer sales are currently coming from Top 10 brands, +3% from pre-pandemic numbers.

Value – About 50% of consumers say that “a good deal” is more important than lower prices. This creates opportunities for value and loyalty programs to drive repeat visits, as well as a chance to offer a range of everyday prices to meet the needs of all consumers.

The On-premise Experience – While some consumers may have learned to mix drinks or have installed a kegerator during quarantine, they can’t replicate the expertise and camaraderie found in their favorite bar or restaurant, and they’re more excited than ever to experience everything the on-premise offers.

Pandemic Business Practices – Focus on changes customers love, like takeout, outside seating and social media engagement. About 77% of consumers say that they will continue their takeout habits post-pandemic. Keep using online food delivery services or your own web ordering systems – a large restaurant in Kramer’s market reported that they will add 10% to their business annually by offering more extensive takeout options.

Expect continued requests for outdoor seating. There has been an upswing in requests for outdoor seating through the summer, to the point where many customers communicate that they would rather wait to be seated outside even when there are immediate inside seating options.

And whether you’re running a wildly popular TikTok account or just keeping your website up to date, every little bit helps – 80% of 21–34-year-old consumers look up an account before they visit, and 70% of consumer purchases are digitally influenced (up from 49% pre-pandemic). If consumers can’t find the information they’re looking for on your website or social channels, they’ll go elsewhere.

The Roaring 2020s: Let’s Keep it Going

Even as we celebrate growth from 2019 numbers, it’s important to remember that all things must evolve to meet customers’ changed expectations due to their experiences during the pandemic. Whether it’s a different mix of draught or even fundamental changes to your business model, lessons learned from the pandemic are valuable because “normal,” as much as we all long for it, is a moving target.”